Ready to use legal template

Work on without any hassle

Compliant with Malaysian law

Ready to use legal template

Work on without any hassle

Compliant with Malaysian law

Home › Accounting › General receipt

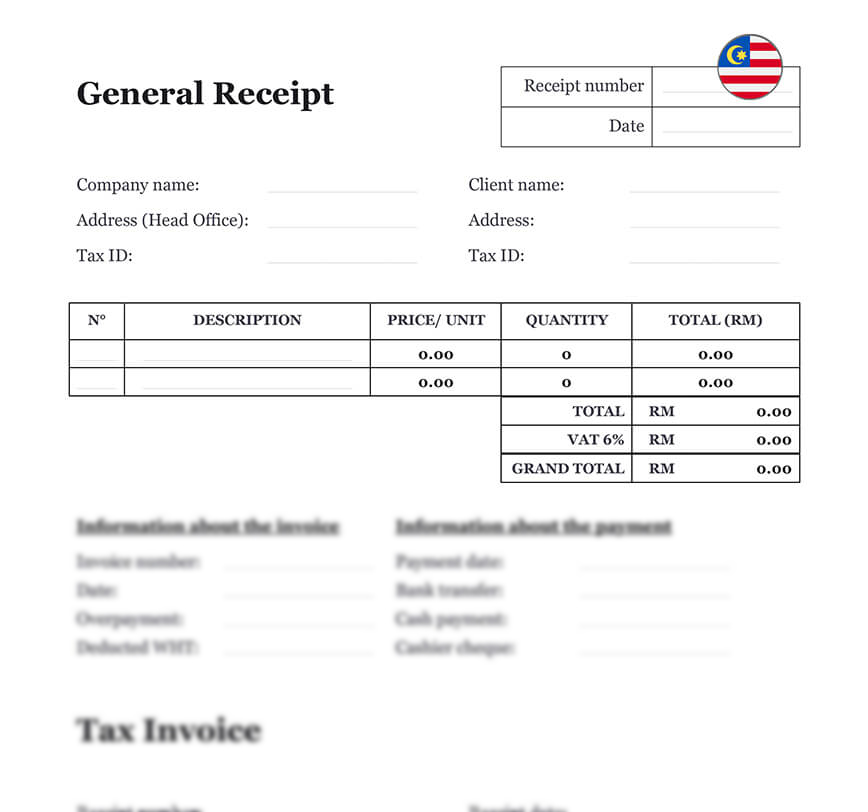

Learn more about General Receipt in Malaysia

A General receipt is a legal document that acts as proof of payment for a product or service. It is given to the customer who gets the commodity or service by the seller, who will produce an invoice. When bills are produced and the client pays, it is typical for the lender to issue a payment receipt, which acknowledges receipt of money. A general receipt informs the client that the creditor has received the money owed. In other words, a general receipt serves as proof of payment for both the Invoice issuer and the invoice recipient. Get a general receipt template in compliance with accounting rules, from Themis Partner. You can also use the services of our accountants to help you handle your accounting.

Table of contents

What is a General Receipt?

A Receipt is proof of payment, whereas an Invoice is a request for payment. It is a document that confirms that a consumer received the products or services for which they paid a business or that the business was properly reimbursed for the goods or services provided to a customer. Though receipts are not legally required for all transactions, they are almost usually issued to customers after they complete a purchase, making them widespread among both traditional and e-commerce enterprises.

Receipts are a vital proof-of-purchase document for both customers and companies, regardless of how they are distributed. Customers want receipts in the event that they have problems with a product or wish to return or exchange it, and you must be able to verify that a customer’s claims are true. Keeping track of customer orders and receipts can be difficult, especially if the customer wishes to return or exchange something; a high-quality order management system can make tracking orders, sending accurate receipts, and assisting customers who require assistance after the transaction much easier.

How to draft a General Receipt?

Because receipts are significantly less comprehensive than invoices, they are even easier to create. They do, however, include vital transactional information. They do not require a unique identification number or client information, but each receipt you issue should have the following information:

| ➤ Name, logo, and contact information for your company |

| ➤ The selling date |

| ➤ A detailed overview of the items and services sold |

| ➤ The cost of each goods and service sold |

| ➤ Any coupons or discounts |

| ➤ The whole amount paid, including any applicable sales tax or fees |