Ready to use legal template

Work on without any hassle

Compliant with Malaysian law

Ready to use legal template

Work on without any hassle

Compliant with Malaysian law

Home › Accounting › Payslip

Learn more about Malaysia Payroll Service

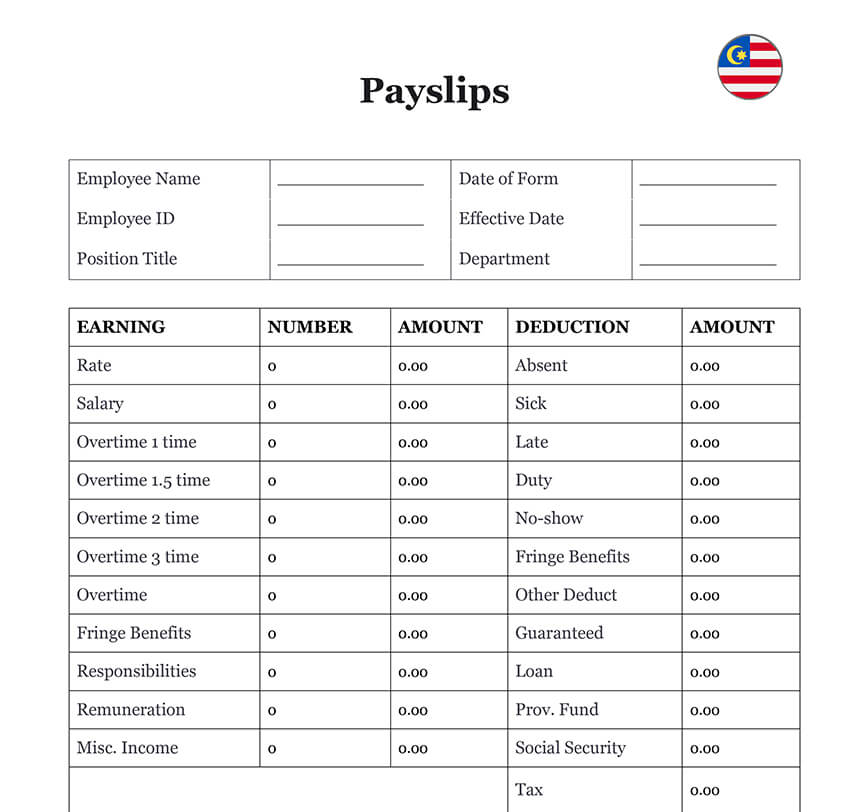

A Payslip, also known as a wage slip, is a document that employers give to employees each time they receive their paycheck. The primary purpose of the payslip is to inform the employee of his or her gross pay, deductions, and residual net pay. The payslip also acts as proof of earnings and employment. Themis Partner allows you to create fully customized payslips for use in Malaysia that include both company and individual employee information.

Table of contents

What is a Payslip?

The Malaysia Employment Act of 1955 requires the issuing of payslips. Every employer must provide a statement to each employee detailing the pay and other allowances earned during the wage period. For Employers, it serves as proof that the corporation fulfilled its obligations to its employees. It is also a salary expense document for the company’s expenditure.

Employees can use this as proof that they are employed by the company, and it reflects the right wage amount/statutory deductions as indicated in the employment contract. It can also be used to calculate/deduct taxes and provide tax information. Employees may also utilize this as a credit referral for financial institutions for loan applications, as well as for other purposes to demonstrate income.

Using an accountant or payroll provider as your Themis Partner for employee payments and payroll fulfillment is frequently faster and more convenient.

Why is Payslip important?

Manual and electronic payslip malaysia formats are both acceptable forms of document proof. Modifying a previously issued payslip is a criminal violation. As a result, a business must ensure that employees cannot change their pay stubs.

It serves as vital legal verification of employment. With the help of Payslip, you can obtain loans, mortgages, or other borrowings because it ensures that your lending will be repaid. It is an essential source of revenue that can be used to prepare income tax returns. Having a valid payslip allows you to access numerous government services such as medical care, etc. It aids in salary negotiations with new jobs for higher pay.

What does Payslip contain?

Employers in Malaysia are required by law to furnish employees with payslips that include personal information such as proof of wages, tax paid, and any pension payments. The following fundamentals must be included:

| ➤ Gross pay is the original payment made before any taxes are deducted |

| ➤ Net pay, which is the amount you earn after taxes are subtracted |

| ➤ The payroll code: every employee is assigned a unique payroll number, which is frequently produced by the company's payroll software |

| ➤ Tax ID, pension ID, and social security number: If you are required by law to pay taxes or make donations, you will be granted a unique file number for the purpose of keeping records with government authorities |

| ➤ Sick leave and other forms of leave may be billed individually on your pay stub |